by Rachel Garza

What do you do with the money you earn? Spend a part of it and save the rest? Yes, that's what the majority of the people do. But over time people have started saving their money in bank accounts as they are a more safe and convenient way of keeping money. All the banks are equal when it comes to the security perspective but not the same when you talk about the APY you get. Usually, banks are a good place to keep your money but not earn from it as you get no more than 0.09% yearly. That's near to nothing! Thus, if you are looking to get more profit from your resting money, you should consider High Yield Savings Accounts

Contents

These accounts not only let you keep your money safe and secure. But also give you APY up to 2%, which is many times more than the national savings. This means not only you can keep your money secure but also earn through the resting money. There are also some online High Yield Savings Accounts. It means they do not have a physical existence but give you a good profit on your money. Let's tell you about some High Yield Savings Accounts that you can use to get a better profit.

Contents

| High Yield Savings Accounts | %APY |

| Fitness bank | 2.20% |

| CIT Bank | 1.80% |

| Marcus by Goldman Sachs | 2.15% |

| Discover Bank | 1.60% |

| CIBC, USA | 1.80% |

| Capital One | 1.75% |

| American Express | 1.70% |

Minimum to open : $100

Minimum ongoing balance: $100

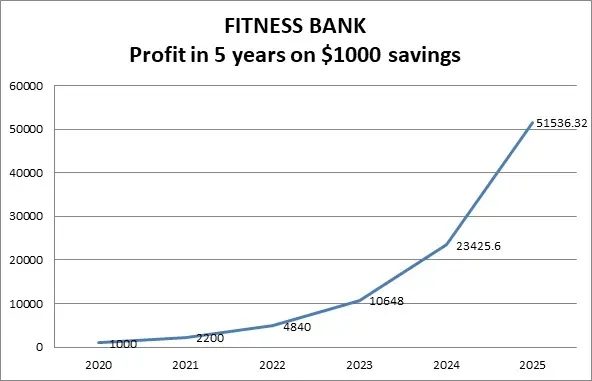

Let's begin with the bank that gives you the highest APY (according to the latest findings on March 05, 2023). Fitness bank is an excellent option if you are looking for a higher Yield. For those who don't know, Fitness Bank lets you earn higher interest if you have a healthy lifestyle. It says that you can get more profit if you take more steps. You can do this by connecting your Fitness Bank Savings account to your Fitness Bank Tracker App that tracks your steps and helps to get a higher APY. As the bank is an online setup only, you do not get the facility of an ATM card and no mobile check deposit facility. 2.20% APY is the highest offered by The Fitness Bank, but you need to maintain 12,500 daily steps to get this. However, the bank offers other APY tiers for low steps counts too. The minimum constant balance of $100 helps you omit the $10 monthly fees otherwise.

Get the Fitness Bank app for Android and iOS.

Minimum to open : $100

Minimum ongoing balance: $25,000 for Savings builder, $0 for the Premium High Yield Account

The Bank Saving's Builder account also yields a $300 bonus (conditions apply)

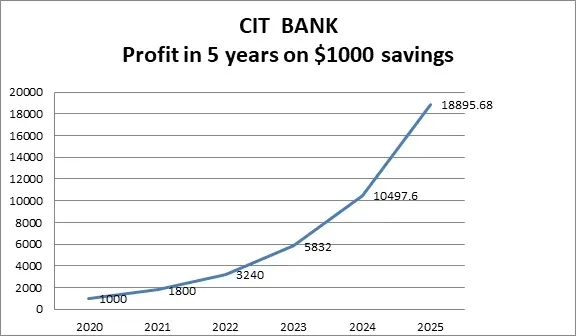

CIT Bank is an online bank with a prominent money market savings account, checking accounts, and high yield saving options. CIT Bank offers you an Annual Percentage Yield of 1.80%, which is much higher than many other accounts. Also, there is no need for a minimum ongoing balance in the account to avail of this. Though it is an online bank, so you don't get free ATM networks. But it has great rates on money market and high yield savings account. So, this makes CIT one of the most popular high-yield savings accounts. CIT Bank offers two savings account options. One of which is the Savings builder account that gives a 1.80% APY, whereas the Premium high yield earns 1.55% APY currently. Yet, the Savings Builder account requires a least of $25,000 or a monthly $100 deposit to obtain the APY. And the Premium High Yield account does not have any such deposit conditions. There is no monthly fee on CIT's eChecking as well.

Get the Android and iOS app now.

Minimum opening fee: $0

Minimum balance requirement: $0

Monthly fees: $0

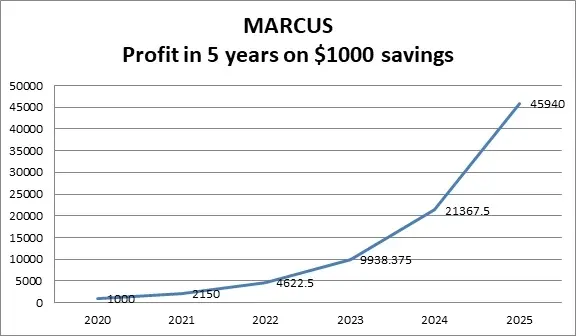

Marcus is an excellent choice for people looking for a top value high yield savings account as it gives 2.15% APY. It is one of the best options for a high yield savings account as it also lets you save money by other means than giving you a higher profit. Marcus does not ask for any minimum amount to open the account or get the desired APY. Also, you do not have to pay any monthly fee for your Marcus high yield savings account. Isn't that great? It surely is! Marcus offers a generous funds transfer limit, but it does not have the facility of mobile check deposit. The bank does not qualify as a full-service online bank, but it offers high yield CDs in addition to the high yield savings accounts. So, if you are looking for a high yield bank that gives you the feasibility to operate your account on your utmost ease, Marcus is the right choice with minimum terms and conditions.

Get the Marcus app for iOS now.

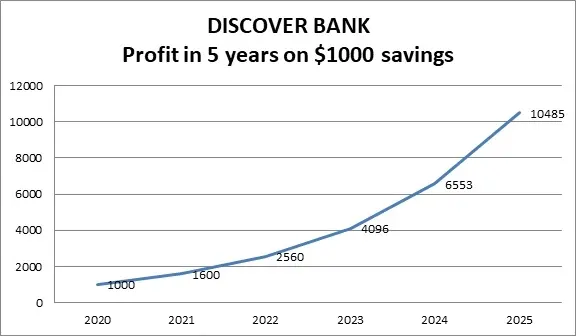

Minimum opening fee: $0

Minimum balance requirement: $0

Monthly fees: $0

If you are looking for banking options that do not require maintenance fees or minimum opening balance limitations, you can try Discover Bank's high yield savings account. Apart from it, Discover bank also offers a $200 bonus on opening an account with at least $15,000. But who dislikes free money anyway! Discover Bank is among the high yield savings accounts with an APY of 1.60%. More or less, this is similar to other high yield savings account. But Discover Bank offers its own set of benefits like the best credit card rewards and offerings in the credit card industry. Discover bank also does not ask for any monthly or maintenance fees or any excessive bank check or withdrawal fees. The bank also offers money market accounts, CDs, and checking accounts.

Get the Discover Bank app for Android and iOS.

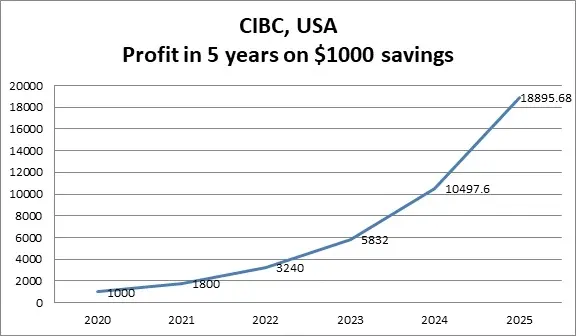

Minimum to open : $1000

Minimum ongoing balance: $0.01

Monthly fee: $0

CIBC USA is a US arm of the Canada-based CIBC Bank, but it is quite a favorite among people who tend to be interested in a high yield savings account. The Agility online savings account earns you a 1.80% APY, which is excellent! More good news is that there is no minimum balance condition to obtain this APY, and also, the bank does not ask for any monthly fees. The CIBC USA Agility Account has a 24-hour online banking facility. While opening the account, the bank gives you a bonus of $200 or $400 on the deposit of $25,000 and $50,000, respectively. However, there is one drawback of the Agility Online Savings account that it requires a minimum of $1000 to open the account. And, it would be best if you had at least an ongoing balance of $0.01 to avail the APY.

Get the CIBS mobile app for iOS and Android now.

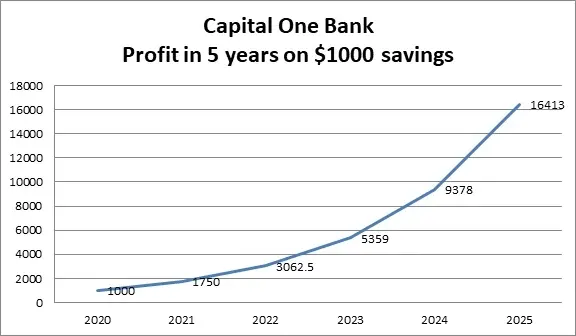

Minimum opening fee: $0

Minimum ongoing balance: $0

Monthly fees: $0

Capital one is another credit card company that has made its name with its other banking facilities like money market, checking accounts, and high yield saving accounts. Capital one high yield savings account gives a hefty 1.75 APY, which is five times more than the average national rate! Capital One makes it quite easy for you to have more than one account. Yes, you can have as many high yield savings account as you want. That, too, with no minimum balance to open the account or limitation of least ongoing balance in the account. Capital One users can utilize up to 39,000 free ATMs across the United States. It also lets you make transactions with the Capital One debit card without having to pay for any foreign transfer fees. Another additional feature is the automatic savings plan that transfers money directly from the checking account to the high yield savings account.

Find the app for Android and iOS.

Minimum to open : $0

Minimum ongoing balance: $0

Monthly fees: $0

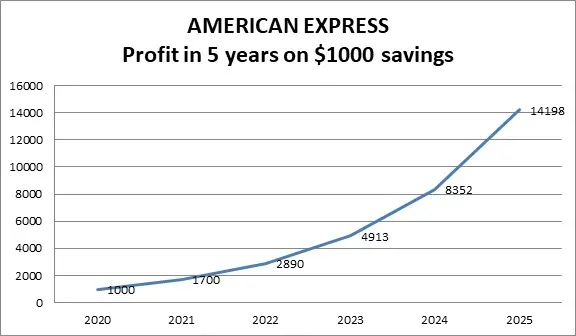

The FDIC American Express Personal Savings is among the top options for a high yield savings account. It gives you a significant annual percentage yield as well as some notable certificates of deposit. The American Express savings account offers a 1.70% APY, which is many times more than the average national APY rate. You can transfer money to/from your checking account for spending purposes as American Express does not provide ATM cards or checks. You can make as many transactions as you wish. The high yield savings account can be opened in a matter of a few minutes without any minimum opening amount conditions or any hidden fees to pay. American Express offers you a unique feature of savings calculator that lets you predetermine the amount of profit you would earn on your deposit. Though, American Express does not provide online chat-support in case of any inconvenience.

Get the Amex app for Android and iOS .

So, if you are looking for a high-yield savings account that provides additional benefits, these seven are among the best choices. You can avail of several different advantages through them. Select the high-yield savings account of your choice and get ready to get the ideal APY you have always wanted!

About Rachel Garza

Rachel Garza is a passionate writer with a deep fascination for technology and science. Born and raised in an intellectually stimulating environment, she developed an early interest in exploring the latest advancements and breakthroughs in these fields. Rachel's love for writing and her insatiable curiosity led her to pursue a career as a tech and science writer.

|

|

|

|

Check These Out